Credit Acceptance Integration for Auto Dealers

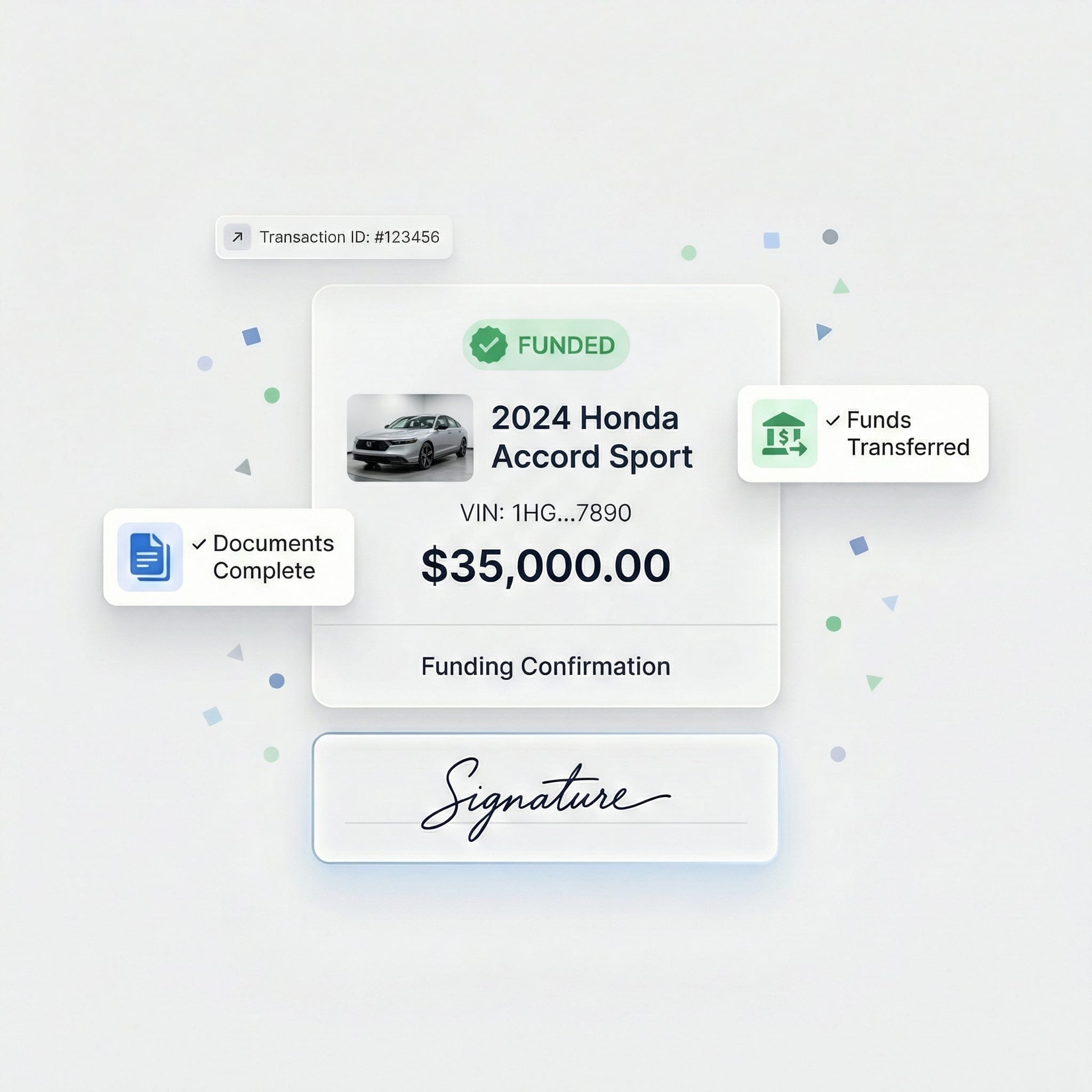

Connect Credit Acceptance to your dealership software and access their portfolio program directly. Dealer Essential's CAC integration lets you submit subprime applications, track portfolio income, and get same-day funding—all from one platform.

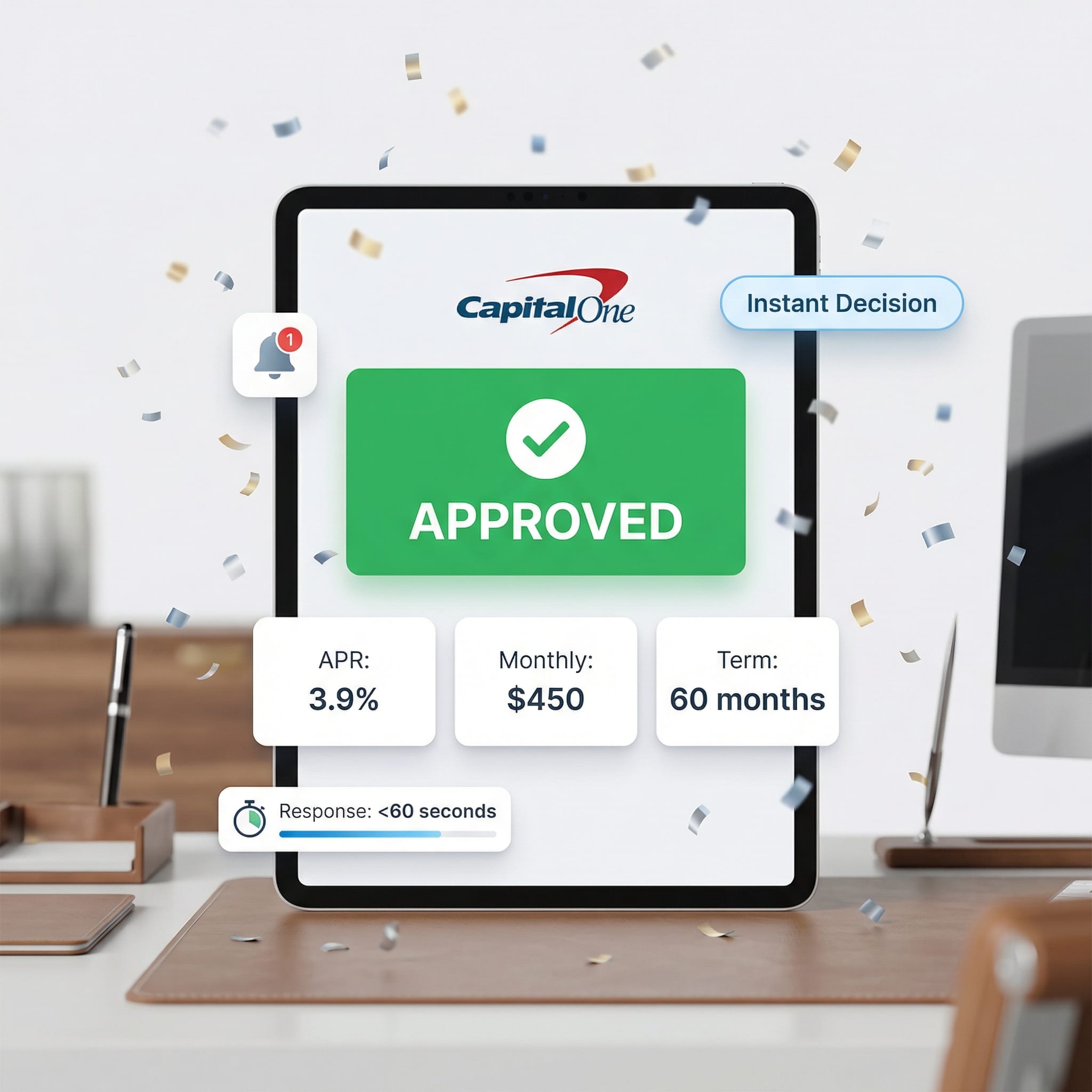

From Credit App to Funded in Minutes

See how seamless financing becomes with Credit Acceptance

Swipe to explore steps →

Why Credit Acceptance + Dealer Essential

Streamline your financing workflow and fund deals faster

Upfront advance + ongoing portfolio income

No collections or repo hassles

Portfolio performance visible in dashboard

Ideal for high-volume subprime dealers

Complements BHPH for mixed inventory

Enterprise-Grade Security

Your customer data is protected by the same standards banks use

Bank-Level Security

256-bit encryption for all data

PCI Compliant

Level 1 PCI DSS certified

SOC 2 Type II

Audited security controls

FCRA Compliant

Consumer credit protection

What Dealers Say

Robert Kim

Lone Star Auto Center, Houston TX

“I switched half my subprime volume to Credit Acceptance 18 months ago. Between advances and portfolio checks, those deals have paid me 3x what traditional subprime would have. It's changed how I think about financing.”

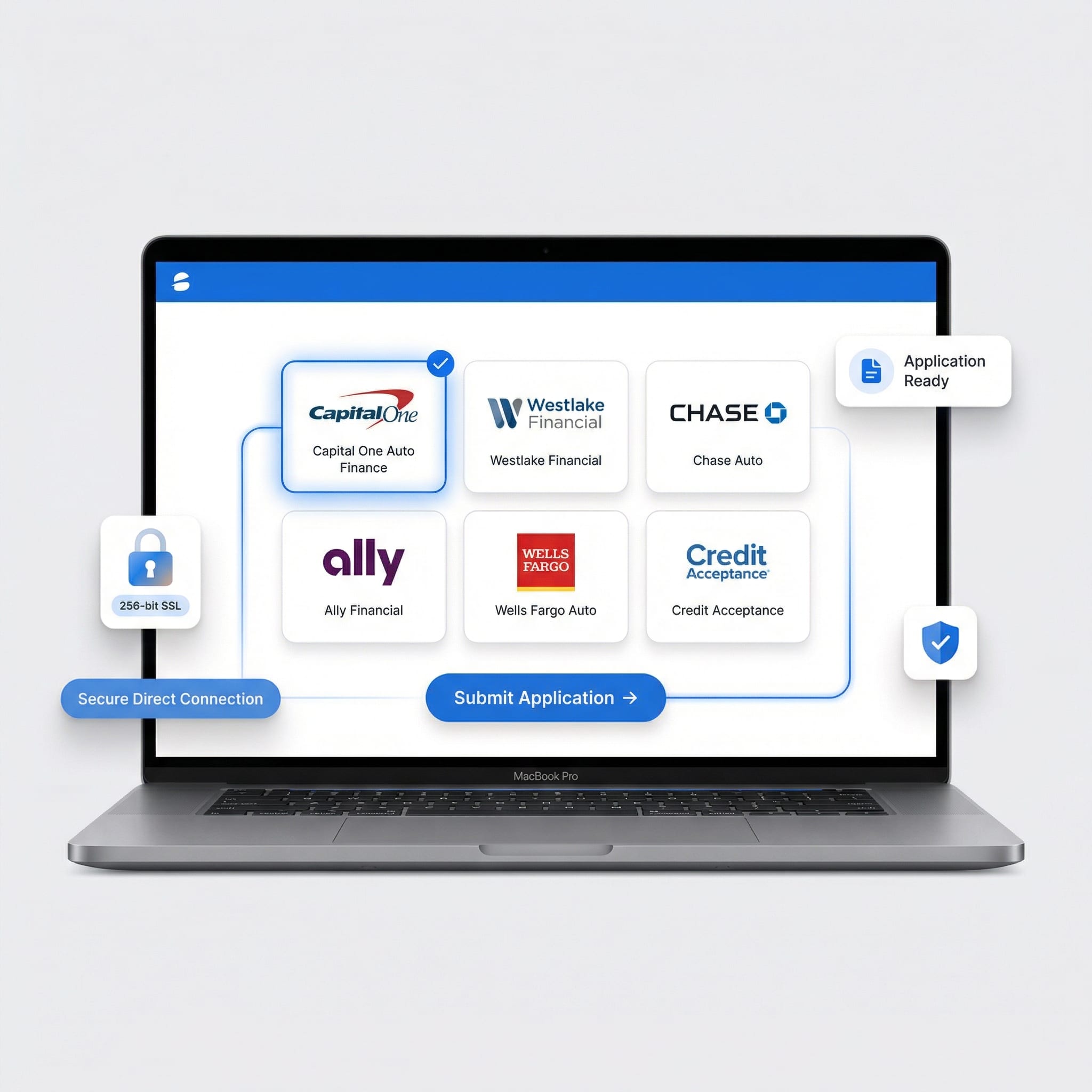

Access All Major Lenders

One platform, every lender your customers need

Credit Acceptance FAQ

Common questions about connecting

Still have questions? Visit our support center or book a free demo